Credit is neither capital nor its creates capital. The credit instruments only represent money and facilitate the business. The importance of credit can be judged by the following functions:

- Large Scale Production :-

Less developing countries like Nigeria face capital shortage problem. Our production sources are limited. So credit instruments have provided the money to the industrialists. Now production is on large scale and cost per unit has been reduced. The quality and quantity has been improved.

- Increases In Saving Rate :-

Credit provides an opportunity to save the money some people save the money but they are not capable to do any business. So they lend it to the financial institutions. Credit makes possible the shifting of money to those people who can use it for productivity.

- Shifting Of Capital To Productive Purposes :-

There are so many people who have surplus money but they are not capable to do any business. So they lend it to the financial institutions. Credit makes possible the shifting of money to those people who can use it for productivity.

- Economy In The Use Of Metal :-

Credit instruments are used in place of metallic coins. So there is a saving of precious metals also. Further use of credit instruments is more effective and convenient.

- Provision Of Working Capital :-

Some times an industrialist faces the finance problem to purchase the raw material or for the payment of wages. So he avails the credit facility.

- Sale Of Bonds :-

Some time a firm can obtain credit by selling the bonds. If the firm prospects are bright it will repay the principal amount with interest.

- Case Of Young Firm :-

Credit enables the manager of a young firm to develop its resources at a rapid speed.

- Emergency Of New Businessman :-

Credit makes possible the entrance of new talent in the business enterprise. If the person has all the qualities of a good entrepreneur but having no capital, credit provides him the chance to utilize his qualities.

- Purchase Of Goods :-

Credit enables the consumer to purchase the consumption goods like T.V. Radio, Car House etc.

- International Payments :-

Through the bills of exchange international payments can be made very easily. There is no need to import or export the gold for the international business transactions.

- Useful For The State :-

If the Govt. Budget is deficit, it can be met by selling the bonds and receiving the credit. Even in case of emergency, war, credit is very beneficial for the state.

INSTRUMENT OF CREDIT

Promissory Note:

The simplest form of a credit instrument is the promissory note. A promissory note (or pro-note for short) is a written promise from a buyer or a borrower to pay a certain sum of money to the creditor or his order. It is what we call IOU (I owe you), i.e., an acknowledgment of debt and an obligation to repay.

The words “value received” indicates that the document is the result of some purchase or loan. Interest must be mentioned; otherwise the pro-note is not good in law. Such a document can be used for any kind of transaction, personal or commercial.

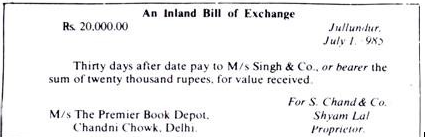

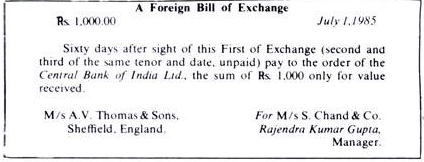

Bill of exchange:

A bill of exchange is used in internal as well as foreign trade. It is an order by a seller to a buyer or by a creditor to a debtor to pay a certain sum of money to himself or to bearer or to another person named therein. The seller or the creditor who draws the bill is called the ‘drawer’; the purchaser or the debtor on whom the bill is drawn is called the “drawee.” The seller may order the payment to be made to a third person called the “payee”.

Specimens of inland and foreign bills of exchange are given below:

In place of the payee’s name any of these forms may be used:

- Pay to bearer,

- Pay to Dr. J. D. Varma or order, or

- Pay to my order.

When the bill of exchange begins with “On demand”, instead of “thirty days”, it is a “demand bill’ or “sight bill’.

The drawer sends ‘he bill to the drawee who “accepts” it by signing it and putting his office stamp on it. The bill now becomes a negotiable instrument and can be bought and sold in the market. The drawer can now discount it and change it into cash on paying a commission, called discount, at some firm or bank. It may pass through several hands before it ultimately matures or falls due for payment, when the drawee pays his debt by honouring the bill.

If the drawee is not very well known, he secures the services of an Accepting House to sign and accept the Bill. Such houses or firms specialize in providing guarantees and charge a commission for their services. To perform such services the Accepting Houses have to keep themselves well informed of the financial position of the merchants on whose behalf they accept bills.

Bank Drafts:

A cheque can also be used to remit funds to another place. But as the account is held in a different place, from where the cheque is presented, the latter branch of the bank normally gets in touch with the former before making the payment. To avoid this botheration, a banker’s draft is used.

A bank draft is a cheque drawn by a bank on its own branch or on another bank requiring the latter to pay a specified amount to the person named in it or to the order thereof. The cheapest method of sending money is through a bank draft.

Bond/ Debenture

A corporate bond or a debenture is a credit instrument in which the issuer obtains cash from the initial investors at origination and, in return, agrees to make payments of interest and, at maturity, of principal to holders of the securities. A bond or debenture is a long-term, fixed-income, financial security. Debenture holders are creditors or lenders to the firm.

Mortgage Agreement

Mortgage is the transfer of an interest in specific immovable property for the purpose of securing the payment of money advanced by way of loan, an existing or future debt or performance of an engagement,which may give rise to a pecuniary liability.

CHEQUE

A cheque is an unconditional order, drawn on a specified banker and is payable on demand.Cheque is one of the earliest forms of a credit instrument. It is utilized by consumers as a legitimate means of paying for goods and services received; the value of the cheque is underwritten by funds that are placed in a bank account. Upon the presentation by the recipient of the credit instrument, the bank deducts the specified amount as recorded on the cheque by the debtor. While the cheque is no longer the main credit instrument employed in many financial transactions, it remains in use by many businesses and individuals.

LETTER OF CREDIT

In a financial letter of credit (LC), the creditor guarantees the repayment of counter party’s obligation and, in return, receives a one-time or periodic fee. Thus, a bank could issue a financial LC in support of a customer obtaining short-term cash from a money market fund that offers an attractive rate. In a financial LC, the bank essentially provides credit insurance. The instrument’s contingent pay-offs mirror those of a credit default swap.

A Letter of Credit (LC) is a letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make payment on the purchase, the bank is required to cover the full or remaining amount of the purchase. A letter of credit is often abbreviated as LOC or LC, and is also referred to as a documentary credit.

CREDIT CARD

The credit card is an example of a common credit instrument. Using a credit card to pay for a purchase creates a contract between the buyer and the seller. Essentially, the seller is extending credit to the buyer with the assumption that the company issuing the card will cover the amount of the purchase. In turn, the issuer of the credit card is anticipating that the cardholder will eventually pay off the amount of the debt along with applicable interest and finance charges.